Second Price Auction in Real Time Bidding is a model where the winner pays 1 cent more than the second highest bid in the auction instead of the price that won him the bid.

For Example: If there’s a bid that is happening for an inventory and let us assume there are 4 advertisers and they bid the following price,

Advertiser A: $2.00

Advertiser B: $2.50

Advertiser C: $1.75

Advertiser D: $3.50

Here, winner will be Bidder D but they pay $2.51 (Second highest bid + $0.01) instead of $3.50.

How Ad Exchange floor price comes into play?

Now that we know how Second Price Auction works, many publishers might be losing revenue because of this. That is because, in the above example, even though Bidder D is willing to pay $3.50 for the inventory they’re interested in, in the end, they pay only $2.51 which means $0.99 lost in revenue for publishers.

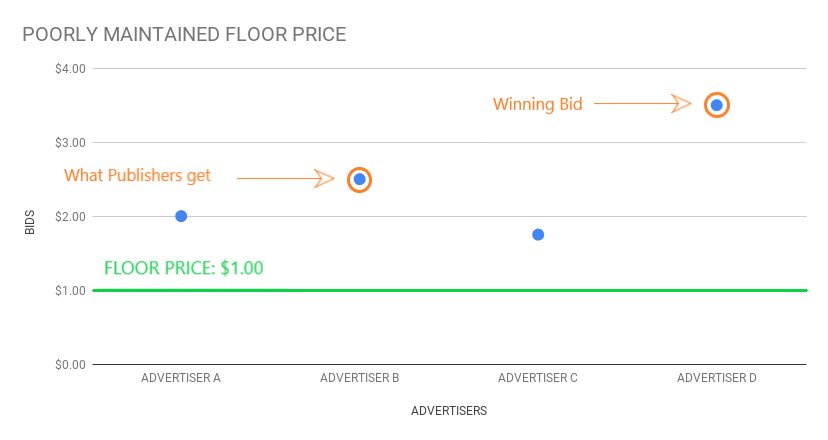

One way for publishers to minimise lost in revenue is by putting the proper Pricing Rules in place. Let us consider the above example again,

Advertiser A: $2.00

Advertiser B: $2.50

Advertiser C: $1:75

Advertiser D: $3.50

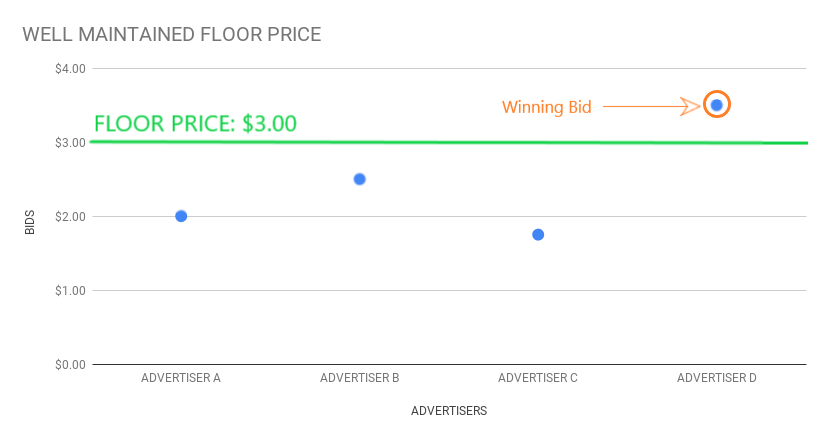

Floor Price: $3.00

Now, let us say there is a floor price set for $3.00, and due to the floor price, all the bids below $3.00 are ignored and hence advertiser D wins but they pay $3.01 instead of $3.50.

Now, the existence of right floor price earned this publisher $0.50 incremental revenue from that inventory. But everything comes at its own risk quotient. So publishers have to be very careful while setting the floor price because a floor Price of say, $3.60 will eliminate all the bids from participating in the auction and there will be unfilled inventories and hence reduction in fill rate or coverage.

So how do Publishers know what is the right floor to use?

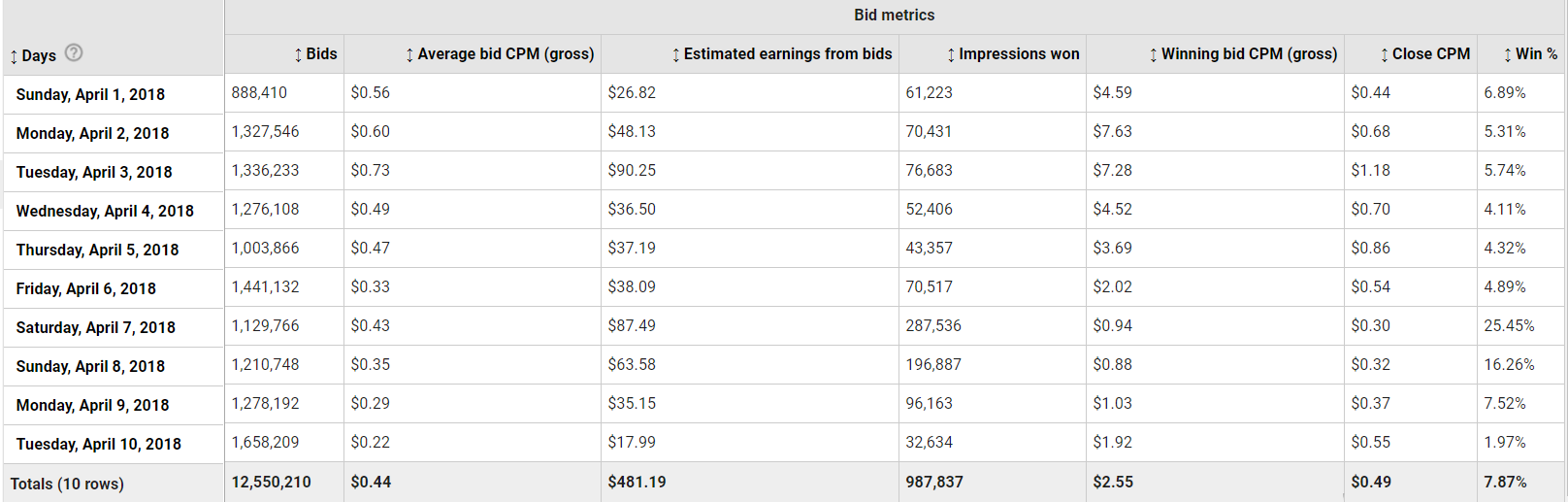

Google Ad Exchange provides bid metrics which can be useful here. But this data is limited as most of the advertisers opt out to give bid information. Yet publishers can get a vague sense of how this works by closely analyzing this data. Some of the useful metrics to look for here are:

1. Bids: Bids are the total number of bids received by an inventory. This includes winning bids as well as lost bids.

2. Winning Bid CPM (gross): Winning bid CPM is the average CPM of all the winning bids.

3. Close CPM: Close CPM is the average CPM of the bids that the advertisers actually pay. Which is one cent more than the second highest bid.

4. Win percentage: Win percentage is percentage of number of winning bids divided by total number of bids.

In the above picture, you can see a huge gap that exists between Winning Bid CPM and Close CPM and how earnings depend on Close CPM. In spite of advertisers bidding highest on April 2nd, publisher is making more money on April 3rd due to high close CPM and one can imagine the upside they get if they scientifically insert a floor price between Winning Bid CPM and Close CPM.

Win percentage may be useful if one wants to set up Pricing Rules for specific advertisers or buyers. For an advertiser, if the win percentage is very high, then that advertiser is bidding a high price and winning most of the bids for that particular inventory. So a high win percentage of an advertiser shows their affinity towards publisher’s inventory.

So having a good understanding of data and bidding patterns is important in setting up of ideal floor prices and maximizing the yield.

Author

Vinay B Rao

Senior Business Analyst, Tercept

0 Comments Leave a comment